I’ve embarked on a mission to bolster my savings, leveraging my knack for couponing and maximizing the resources at my local library. With a cherished friend’s wedding in India on the horizon and the desire to explore the country for two weeks, I’ve set my sights on a goal of $5,050. Now, it’s time to devise a strategy to achieve it.

My detailed plan to help you save $5,050 easily:

- Assess Your Possessions: I started by going through all my belongings to identify items I no longer need or use. This included clothes, gadgets, furniture, books, bags, luggage, etc. My aim was to declutter and adopt a minimalist lifestyle.

- Sell Items Online: I utilize platforms like Facebook Marketplace, Nextdoor and OfferUp, to list my items for sale. Be sure to take clear photos, write detailed descriptions, and price them competitively to attract buyers.

3. Set Monthly Sales Goals: I broke down the $5,050 savings goal into manageable targets. I’ve labeled 100 envelopes ranging from $1 to $100, with each subsequent envelope increasing by $1. On each envelope, I jot down the source or reason for the money enclosed.

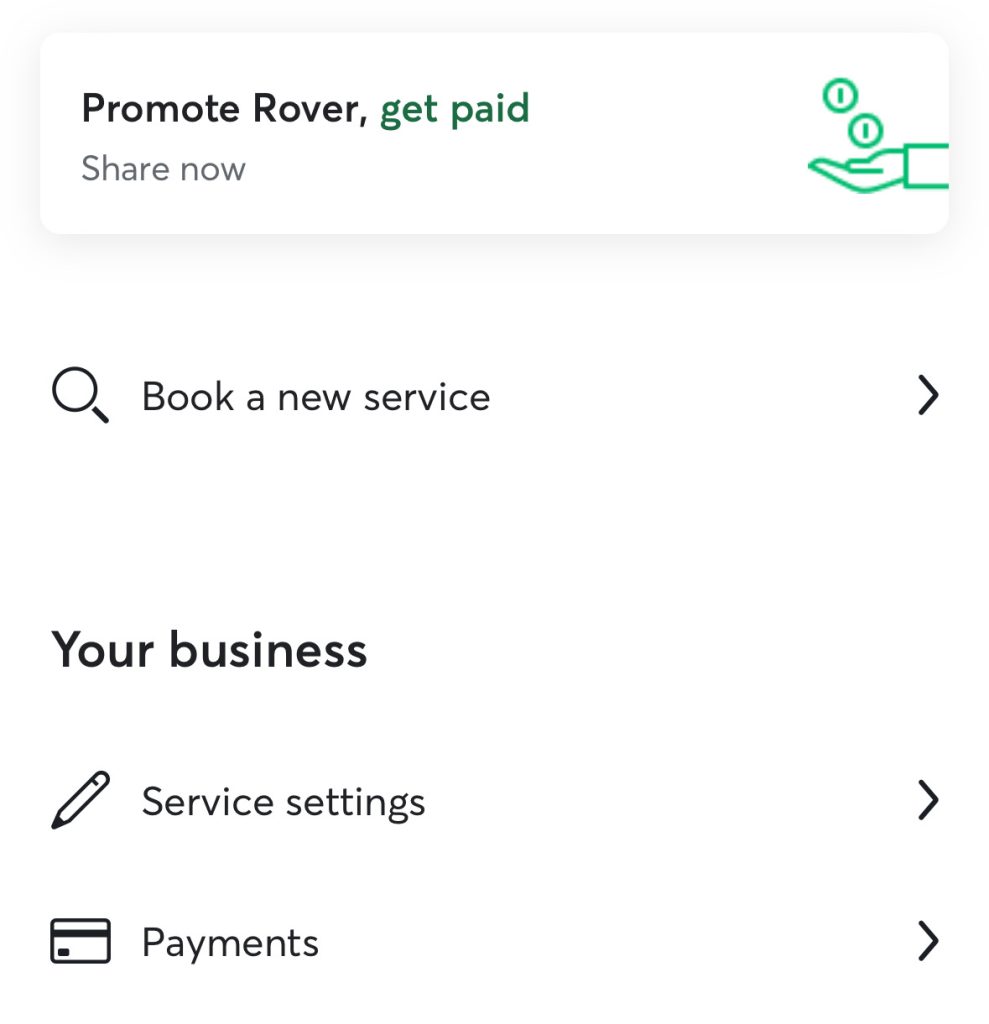

4. Rover Pet Sitting: I signed up for Rover to earn extra income on the side. I offer services like dog walking, house sitting and pet boarding. I love this because I can easily adjust my availability.

5. Couponing and Cashback: I use coupons and cashback apps to save money on my everyday purchases. Then I allocate the saved amount towards my savings goal. I also list unneeded items that I have on Facebook Marketplace and Nextdoor. If you want to learn how to coupon check out my entire post on How To: Coupon Like a Boss.

6. Budgeting and Expense Tracking: I’ve created a budget to monitor my income and expenses. Specifically identifying areas, I can cut back on spending (eating out) to allocate more funds towards my savings. You will want to keep track of your progress regularly to stay motivated.

7. Automate Savings: I’ve set up automatic transfers from my checking account to my savings account. For example, I have the American Express which gives me more benefits than I can explain but the big ones are $15 in Uber credits each month and $20 a month in digital entertainment credits. I auto save my Uber fare, Netflix and Hulu each month! this ensures I utilize my credit cards benefits but save the money I would otherwise spend.

9. Stay Focused and Motivated: I keep my goal of going to India for my friend’s wedding in mind as motivation. Visualizing the experience and the joy of being there on her big day is what keeps me committed to my saving goal.

10. Celebrate Milestones: Celebrate reaching milestones along the way, $5,050 is a lot to save and can take a toll on your everyday life. Treat yourself to something small or take a moment to acknowledge your progress. This will help maintain your momentum and keep you motivated.

By following this plan diligently and staying committed to my savings goal, I know I will reach it and you can too!